Featured

Latest News

April 25, 2024

add comment

The National Chairman of the All Progressives Congress (APC), Abdullahi Ganduje, has said that the party is...

BREAKING: Emeka lhedloha Dumps PDP

April 23, 2024

1 comment

April 25, 2024

add comment

Israel DMW reacts as doctor lists benefits of marrying a virgin. Israel Afeare married Sheila Courage but...

Davido’s new private jet reportedly lands in Nigeria

April 25, 2024

add comment

April 25, 2024

add comment

All flight operations in Terminal 1 of Murtala Muhammed International Airport, Lagos have been diverted diverted to...

April 25, 2024

add comment

Liverpool fans, how market? We are asking respectfully. Is there any hope of Jürgen Klopp still winning...

10 reasons to support Chelsea Football Club

April 20, 2024

add comment

World cup: Super Eagles to play South Africa June 7

April 13, 2024

add comment

April 25, 2024

add comment

Prime Minister of Tanzania, Kassim Majaliwa, has announced the shut down of five hydroelectric stations in the...

First female transgender mosque opens in Bangladeshi

April 22, 2024

add comment

April 25, 2024

add comment

The Naira yesterday depreciated to N1,305 per dollar in the parallel market, from N1,255 per dollar on...

BREAKING: FG grounds all Dana Air operations

April 24, 2024

add comment

CBN Sells Fresh Dollars To BDCs At ₦1,021/$

April 23, 2024

add comment

Naira depreciates to N1,250/$ in parallel market

April 23, 2024

add comment

April 25, 2024

add comment

Doctor lists out the benefits of marrying a virgin. If you have the choice, marry a virgin;...

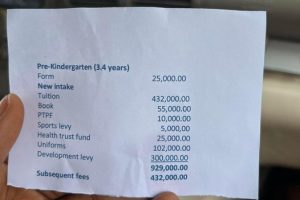

Ovation for Soludo – The Education Governor

April 24, 2024

add comment

Governor Soludo: A Jolly Good Friend Of The Press

April 24, 2024

add comment

CS2 Gaming Sites

April 23, 2024

add comment

April 14, 2024

add comment

The National Drug Law Enforcement Agency has announced the discovery of a dangerous drug concoction named “Combine.”...

Jigawa confirms outbreak of meningitis in 6 LGs

March 4, 2024

add comment

April 24, 2024

add comment

Punish my abusers within 48 hours or face lawsuit – Student bullied by her classmates threaten school...

BREAKING: Lead British School Temporarily Closed

April 23, 2024

add comment

Female corper shows off location posted for NYSC

April 20, 2024

add comment