Featured

Latest News

April 23, 2024

add comment

A former director-general of the Labour Party presidential campaign, Doyin Okupe, says the party’s presidential candidate, Peter Obi,...

BREAKING: Emeka lhedloha Dumps PDP

April 23, 2024

1 comment

April 24, 2024

add comment

Speed Darlington calls out his mother’s sister for allegedly threatening to k!ll him for asking her to...

Producer Calls Out Davido Over Unpaid Royalties

April 23, 2024

add comment

April 24, 2024

add comment

… Pass Vote of Confidence on NDDC MD Chief Samuel Ogbuku By Martins Ogolo Several youth groups...

EFCC Files Fresh Charges Against Godwin Emefiele

April 24, 2024

add comment

World cup: Super Eagles to play South Africa June 7

April 13, 2024

add comment

April 22, 2024

add comment

First female transgender mosque opens in Bangladeshi In the video shared by DW, some of the worshippers...

April 23, 2024

add comment

The Central Bank of Nigeria (CBN) started fresh and direct sales of US dollars at N1,021 per...

Naira depreciates to N1,250/$ in parallel market

April 23, 2024

add comment

Firstbank Appoints Olusegun Alebiosu As New MD/MD

April 22, 2024

add comment

April 23, 2024

add comment

The landscape of online gaming has been significantly augmented by the advent of CS2 gaming sites, which...

Kwankwaso’s Plot to Oust Ganduje

April 23, 2024

add comment

April 14, 2024

add comment

The National Drug Law Enforcement Agency has announced the discovery of a dangerous drug concoction named “Combine.”...

Jigawa confirms outbreak of meningitis in 6 LGs

March 4, 2024

add comment

April 23, 2024

add comment

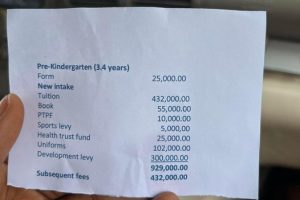

Lead British school has been shut down for three days. More details shortly

Female corper shows off location posted for NYSC

April 20, 2024

add comment