Featured

Latest News

April 19, 2024

add comment

The Speaker of the Kogi State House of Assembly said he has yet to receive the letter...

Ganduje Reacts As Court Stops Suspension

April 18, 2024

add comment

Uzodinma Warns Appointees Of Corrupt Practices

April 18, 2024

add comment

April 20, 2024

add comment

2Face doesn’t live with his sons, Burna Boy may never give birth to any child, Davido k!lls...

April 20, 2024

add comment

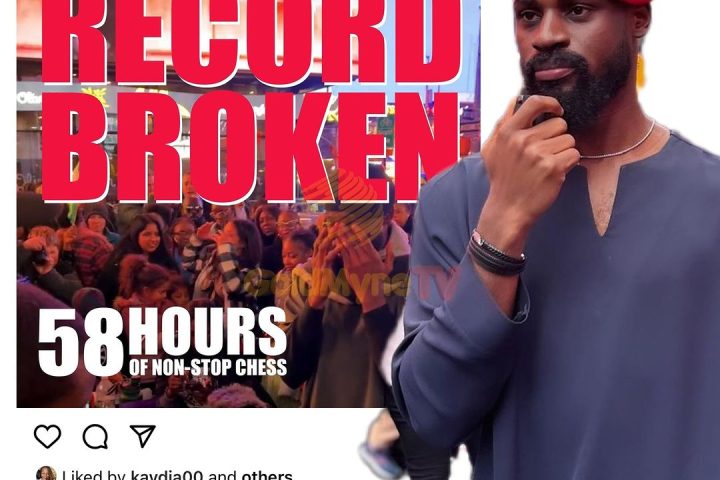

Moment Tunde Onakoya broke the world record for longest chess marathon. Watch video below

President Tinubu Makes Fresh Appointment

April 19, 2024

add comment

World cup: Super Eagles to play South Africa June 7

April 13, 2024

add comment

April 19, 2024

add comment

A protester has set himself on fire outside the New York courthouse where former US President Donald Trump stands trial, Sky...

Israeli missiles hit site in Iran – Report

April 19, 2024

add comment

April 19, 2024

add comment

The 650,000 barrels per day Dangote Petroleum Refinery has been able to ramp up production leveraging on...

Diesel price stands at N1341.16 in March 2024 – NBS

April 18, 2024

add comment

April 19, 2024

add comment

By Christian ABURIME “Carve your name on hearts, not tombstones.” – Shannon Alder Great men are known...

EFCC Vs Yahyah Bello: A Well-Deserved Embarrassment

April 19, 2024

add comment

April 14, 2024

add comment

The National Drug Law Enforcement Agency has announced the discovery of a dangerous drug concoction named “Combine.”...

Jigawa confirms outbreak of meningitis in 6 LGs

March 4, 2024

add comment

April 17, 2024

add comment

…declares zero tolerance for child abuse The Enugu State governor, Dr. Peter Mbah, has approved full scholarship...

Top 15 most employable universities in Nigeria

April 12, 2024

add comment