April 24, 2024

add comment

The Kaduna State House of Assembly has launched an investigation into the financial dealings of the state...

BREAKING: Emeka lhedloha Dumps PDP

April 23, 2024

1 comment

April 24, 2024

add comment

Megan Thee Stallion forced her cameraman to watch her having sex in a moving car, according to...

Producer Calls Out Davido Over Unpaid Royalties

April 23, 2024

add comment

April 24, 2024

add comment

The Economic and Financial Crimes Commission (EFCC), has filed a notice of withdrawal to discontinue an appeal...

Nobody Can Give Me Headache – Yahaya Bello (Video)

April 24, 2024

add comment

World cup: Super Eagles to play South Africa June 7

April 13, 2024

add comment

April 24, 2024

add comment

The US Senate has voted overwhelmingly to provide a USD 95.3 billion aid package to Ukraine and...

First female transgender mosque opens in Bangladeshi

April 22, 2024

add comment

April 24, 2024

add comment

The Minister of Aviation, Festus Keyamo has suspended Dana Airline operations in the country. The directive followed...

CBN Sells Fresh Dollars To BDCs At ₦1,021/$

April 23, 2024

add comment

Naira depreciates to N1,250/$ in parallel market

April 23, 2024

add comment

Firstbank Appoints Olusegun Alebiosu As New MD/MD

April 22, 2024

add comment

April 24, 2024

add comment

By Izuchukwu Adichie Before the coming of Soludo as the governor of Anambra State, the education sector...

Governor Soludo: A Jolly Good Friend Of The Press

April 24, 2024

add comment

CS2 Gaming Sites

April 23, 2024

add comment

April 14, 2024

add comment

The National Drug Law Enforcement Agency has announced the discovery of a dangerous drug concoction named “Combine.”...

Jigawa confirms outbreak of meningitis in 6 LGs

March 4, 2024

add comment

April 24, 2024

add comment

Punish my abusers within 48 hours or face lawsuit – Student bullied by her classmates threaten school...

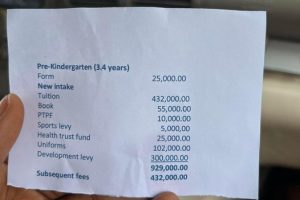

BREAKING: Lead British School Temporarily Closed

April 23, 2024

add comment

Female corper shows off location posted for NYSC

April 20, 2024

add comment