July 12, 2025

add comment

The All Progressives Congress (APC) is reportedly considering welcoming Osun State Governor, Ademola Adeleke, into its fold...

July 11, 2025

add comment

Uche Maduagwu, the controversial Nollywood actor, has criticized May Edochie, urging her to speak out against the...

July 12, 2025

add comment

Ahead of the Lagos Local Government elections on Saturday (today), the Chief Judge of Lagos State, Justice...

July 11, 2025

add comment

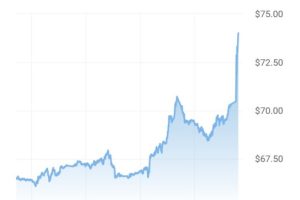

Napoli have rejected a fresh €75m bid from Galatasaray for Victor Osimhen, despite the Turkish giants meeting the...

July 11, 2025

add comment

Canada’s unemployment rate dropped slightly to 6.9 per cent in June due to strong job gains in...

June 28, 2025

add comment

The African Export-Import Bank has sealed a partnership deal with the Creative, Reality, Entertainment, Arts and Music...

July 12, 2025

add comment

SIR AZUKA OKWUOSA: A BASTION OF QUALITY REPRESENTATION; A CATALYST FOR ANAMBRA SOUTH’S DEVELOPMENT. Dear APC Anambra...

Visionless APC and Anambra’s Hapless Cockerel

July 11, 2025

add comment

July 12, 2025

add comment

You can notice signs of HIV on the tongue during the early and late stages of the...

Probe Calabar hospital CMD Group Tells Tinubu

July 4, 2025

add comment

July 11, 2025

add comment

The National Universities Commission (NUC) has presented an operational license to the newly approved Ebonyi State University...