Featured

Latest News

April 25, 2024

add comment

The former deputy governor in Ondo state, Hon Agboola Ajayi has won the State’ s People’s Democratic...

APC Is The Solution To Nigeria’s Problems – Ganduje

April 25, 2024

add comment

April 26, 2024

add comment

An associate of Naira Marley, Law Lee has made headlines after revealing his hatred for the late Mohbad has increased. Nigerian...

Davido Flaunts New $200k Diamond Encrusted Teeth

April 25, 2024

add comment

April 26, 2024

add comment

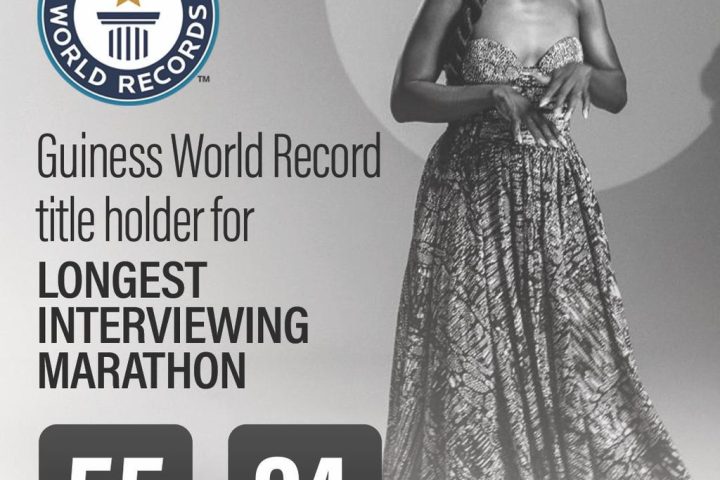

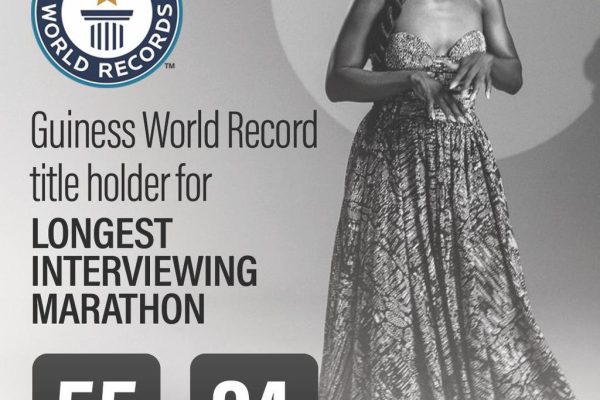

By Christian ABURIME The Governor of Anambra State, Professor Charles Chukwuma Soludo, CFR, has congratulated Clara Chizoba...

April 25, 2024

add comment

Ogun State Governor, Dapo Abiodun, has named Tunde Onakoya as the State’s Sports Ambassador. Hailing from Ago-Iwoye,...

10 reasons to support Chelsea Football Club

April 20, 2024

add comment

April 25, 2024

add comment

President Joe Biden signed into law a national security bill on Wednesday that would force TikTok to...

First female transgender mosque opens in Bangladeshi

April 22, 2024

add comment

April 26, 2024

add comment

The Naira depreciated to N1,405 per dollar in the parallel market, from N1,305 per dollar on Wednesday....

Naira depreciates to N1,305/$ in parallel market

April 25, 2024

add comment

BREAKING: FG grounds all Dana Air operations

April 24, 2024

add comment

CBN Sells Fresh Dollars To BDCs At ₦1,021/$

April 23, 2024

add comment

April 26, 2024

add comment

“The youth is the HOPE of our future.” The Niger Delta Development Commission (NDDC), a Federal Government...

Doctor Lists Out The Benefits Of Marrying A Virgin

April 25, 2024

add comment

Ovation for Soludo – The Education Governor

April 24, 2024

add comment

Governor Soludo: A Jolly Good Friend Of The Press

April 24, 2024

add comment

April 14, 2024

add comment

The National Drug Law Enforcement Agency has announced the discovery of a dangerous drug concoction named “Combine.”...

Jigawa confirms outbreak of meningitis in 6 LGs

March 4, 2024

add comment

April 26, 2024

add comment

The authorities of the Federal Capital Territory Administration (FCTA), have flagged-off scholarship scheme for the 2022/2023 award...

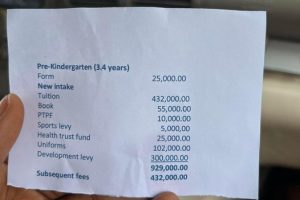

BREAKING: Lead British School Temporarily Closed

April 23, 2024

add comment