Featured

Latest News

July 25, 2025

add comment

The Social Democratic Party has disowned former Kaduna State Governor, Malam Nasiru El-Rufai, declaring that he is...

PDP to Hold National Convention in Ibadan

July 24, 2025

add comment

July 25, 2025

add comment

Veteran Nollywood actor Pete Edochie has shared his thoughts on why Igbo men often struggle in Nigerian...

July 25, 2025

add comment

The Kano Zonal Directorate of the Economic and Financial Crimes Commission, on Friday, secured the conviction and...

July 25, 2025

add comment

Mariam Aruna, the daughter of Nigerian table tennis star Quadri Aruna, is set to make her debut...

July 25, 2025

add comment

More than 220 British MPs, including dozens from the ruling Labour party, demanded on Friday that the...

July 19, 2025

add comment

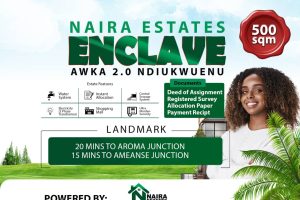

The naira continued its recent streak of relative stability, closing the gap between the official and parallel...

July 25, 2025

add comment

Analysts warn that Israel may be laying the groundwork for renewed military confrontation with Iran, amid reports...

Soludo’s Politics of Development By Isotonu Dulue

July 22, 2025

add comment

July 24, 2025

add comment

—If You’re Getting Slimmer Without Trying, Here’s How to Add Weight Back, Healthily Breastfeeding burns a lot...

July 15, 2025

1 comment

The University of Calabar has ordered over 300 students from its Dentistry Department to leave the institution...