Featured

Latest News

July 10, 2025

add comment

The Nigerian Union of Pensioners (NUP) has vowed to mobilise its members across the Southwest region to...

Wike hails Okpebholo’s S’Court victory

July 10, 2025

add comment

July 10, 2025

add comment

Nollywood actress and activist, Iyabo Ojo, has finally responded to viral videos and mounting social media attacks...

July 11, 2025

add comment

Operatives of the Nigeria Customs Service have intercepted a 40-foot container loaded with donkey genitals along the...

Benue community launches free literacy programme

July 11, 2025

add comment

July 11, 2025

add comment

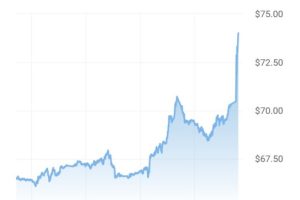

Napoli have rejected a fresh €75m bid from Galatasaray for Victor Osimhen, despite the Turkish giants meeting the...

July 10, 2025

add comment

A French appeals court, Thursday, overturned convictions against two women accused of libel against French First Lady...

June 28, 2025

add comment

The African Export-Import Bank has sealed a partnership deal with the Creative, Reality, Entertainment, Arts and Music...

July 11, 2025

add comment

The Encyclopedia Britannica Editors in their latest update of May 13, 2025, stated that Theatre of the...

Anambra 2025 and Soludo’s Victory Warrant

July 7, 2025

3 comments

July 7, 2025

1 comment

A Nigerian doctor, DS Omeiza has advised people to remove “charms” attached to their bodies before being...

Probe Calabar hospital CMD Group Tells Tinubu

July 4, 2025

add comment

July 11, 2025

add comment

Founder, Olumide Osunsina Foundation, Olumide Osunsina, has urged young Nigerians to see certificates not just as academic...