Featured

Latest News

July 11, 2025

add comment

In a significant move to consolidate internal unity and dispel rumours of division, all 37 state chairmen...

Wike hails Okpebholo’s S’Court victory

July 10, 2025

add comment

July 11, 2025

add comment

Uche Maduagwu, the controversial Nollywood actor, has criticized May Edochie, urging her to speak out against the...

July 11, 2025

add comment

Ibom Air is targeting a ₦150 billion profit for the year 2025, up from the ₦96 billion...

July 11, 2025

add comment

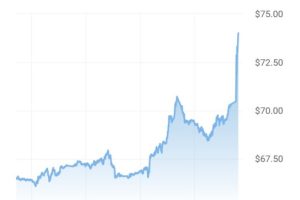

Napoli have rejected a fresh €75m bid from Galatasaray for Victor Osimhen, despite the Turkish giants meeting the...

July 11, 2025

add comment

The Government of Ghana has criticised the United States for slashing the validity of B1/B2 visas for...

June 28, 2025

add comment

The African Export-Import Bank has sealed a partnership deal with the Creative, Reality, Entertainment, Arts and Music...

July 11, 2025

add comment

The Encyclopedia Britannica Editors in their latest update of May 13, 2025, stated that Theatre of the...

Anambra 2025 and Soludo’s Victory Warrant

July 7, 2025

3 comments

July 7, 2025

1 comment

A Nigerian doctor, DS Omeiza has advised people to remove “charms” attached to their bodies before being...

Probe Calabar hospital CMD Group Tells Tinubu

July 4, 2025

add comment

July 11, 2025

add comment

The National Universities Commission (NUC) has presented an operational license to the newly approved Ebonyi State University...