Featured

Latest News

July 23, 2025

add comment

The founding fathers of the Peoples Democratic Party have called for the party’s 2027 presidential ticket to...

Another Reps Member Resigns from PDP in Osun

July 23, 2025

add comment

July 23, 2025

add comment

Nigerian music star, Peter Okoye of P-Square, is celebrating a major milestone — 30 years on stage....

July 23, 2025

add comment

The Medical Guild, an association of doctors under the employment of the Lagos State Government, has decried...

July 23, 2025

add comment

Udinese and Nigeria goalkeeper Maduka Okoye has been handed a two-month ban by the Italian Football Federation following...

July 23, 2025

add comment

Tokyo stocks surged Wednesday after Japan and the United States finally hammered out a trade deal to...

July 19, 2025

add comment

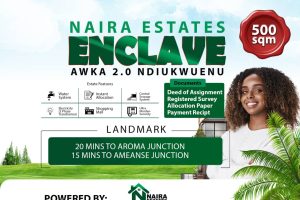

The naira continued its recent streak of relative stability, closing the gap between the official and parallel...

July 22, 2025

add comment

Governor Charles Chukwuma Soludo, CFR, has completely changed the tenor of politics in Anambra State. While the...

July 22, 2025

add comment

Health workers in Abia state have raised alarm over the increase in cases of HIV/AIDS in the...

Tongue and Mouth Early Signs of HIV

July 12, 2025

add comment

July 15, 2025

1 comment

The University of Calabar has ordered over 300 students from its Dentistry Department to leave the institution...