Featured

Latest News

July 10, 2025

add comment

Minister of the Federal Capital Territory, Nyesom Wike, has hailed the Supreme Court judgment, affirming the victory...

July 10, 2025

add comment

Nollywood actress and activist, Iyabo Ojo, has finally responded to viral videos and mounting social media attacks...

July 10, 2025

add comment

Ibadan North residents write open letter to APC national secretary, Surajudeen Ajibola Basiru Read the letter below…...

July 10, 2025

add comment

Nigeria’s Super Eagles have dropped one place to 44th in the latest FIFA World Rankings released on...

July 10, 2025

add comment

A French appeals court, Thursday, overturned convictions against two women accused of libel against French First Lady...

June 28, 2025

add comment

The African Export-Import Bank has sealed a partnership deal with the Creative, Reality, Entertainment, Arts and Music...

July 10, 2025

add comment

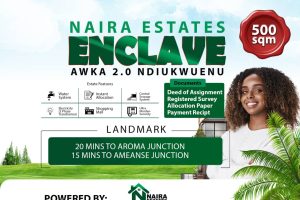

Now that the November 8, 2025 Anambra State gubernatorial election is on the front burner, it is...

Anambra 2025 and Soludo’s Victory Warrant

July 7, 2025

3 comments

July 7, 2025

1 comment

A Nigerian doctor, DS Omeiza has advised people to remove “charms” attached to their bodies before being...

Probe Calabar hospital CMD Group Tells Tinubu

July 4, 2025

add comment

July 9, 2025

add comment

The Joint Admissions and Matriculation Board (JAMB) has announced a major policy change that will see the...

ASUU announces nationwide strike

July 7, 2025

add comment