Featured

Latest News

July 17, 2025

add comment

The Peoples Democratic Party has stated that ex-Vice President Atiku Abubakar’s negligence was a key factor in...

ADC Coalition Won’t Threaten PDP, Says Makinde

July 16, 2025

add comment

Atiku and Political harlotry_ His stake in 2027

July 16, 2025

add comment

July 17, 2025

add comment

Robin Kaye, a veteran music supervisor best known for her work on American Idol, has d+ed alongside...

Actor Apologizes for Slapping Fellow Actor on Set

July 14, 2025

add comment

July 17, 2025

add comment

The Nigeria Labour Congress has raised concerns over the country’s poor global standing on workers’ rights, revealing...

July 16, 2025

add comment

Young Barcelona star Lamine Yamal inherited the club’s number 10 shirt, previously worn by all-time great Lionel...

AC Milan confirm Modric’s arrival

July 14, 2025

add comment

July 16, 2025

add comment

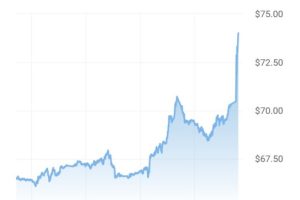

Huawei has reclaimed the top spot in China’s smartphone market for the first time in over four...

June 28, 2025

add comment

The African Export-Import Bank has sealed a partnership deal with the Creative, Reality, Entertainment, Arts and Music...

July 16, 2025

add comment

Nnamdi Azikiwe University, Awka, (UNIZIK), will be appointing a substantive Vice Chancellor few months from now when...

July 17, 2025

add comment

Eight healthy babies have been born in the UK using a new IVF technique that successfully reduced...

Tongue and Mouth Early Signs of HIV

July 12, 2025

add comment

Probe Calabar hospital CMD Group Tells Tinubu

July 4, 2025

add comment

July 15, 2025

1 comment

The University of Calabar has ordered over 300 students from its Dentistry Department to leave the institution...